If you’re looking to get a clearer picture of your business’s financial health, cash flow statements are your best friend. Let’s dive into what they are, why they matter, and how you can use them to your advantage.

What Is a Cash Flow Statement?

A cash flow statement is a financial document that tracks the inflows and outflows of cash within a business over a specific period. Unlike other financial statements, it focuses solely on cash transactions, giving you a real-time snapshot of liquidity. Think of it as your financial GPS—helping you navigate the road to profitability.

People who frequently use cash flow statements include:

- Business Owners: To monitor day-to-day liquidity and ensure bills and payroll are covered.

- Investors: To assess the financial health and operational efficiency of a potential investment.

- Lenders: To evaluate whether a business has sufficient cash flow to repay loans.

- Accountants and Financial Analysts: To identify trends, prepare budgets, and advise on strategic financial decisions.

Why Are Cash Flow Statements Important?

Managing your business without understanding its cash flow is like flying blind. Here’s why they’re critical:

- Assess Liquidity: They show whether you have enough cash on hand to cover your expenses.

- Monitor Cash Trends: Regularly analyzing them helps identify seasonal trends and potential cash shortages.

- Support Decision-Making: Investors and lenders rely on cash flow statements to gauge financial stability.

For a more detailed guide on managing cash flow effectively, check out this article on cash flow management.

Components of a Cash Flow Statement

To make the most of this tool, you’ll need to understand its three main sections:

Operating Activities

This section tracks cash generated or used in daily business operations. Examples include cash received from sales and payments made to suppliers. Positive cash flow here indicates a healthy core business.

Investing Activities

Here, you’ll find cash spent on or earned from investments, such as purchasing equipment or selling assets. While negative cash flow isn’t always bad, it should align with strategic growth.

Financing Activities

This part focuses on cash related to debt and equity, such as loan repayments or issuing shares. It highlights how your business is funded.

How to Prepare a Cash Flow Statement

Creating a cash flow statement may sound daunting, but it’s simpler than you think. Here’s a quick guide:

- Start with Net Income: Use your income statement as a starting point.

- Adjust for Non-Cash Items: Add back depreciation and adjust for changes in working capital. Depreciation reflects the allocation of the cost of a tangible asset over its useful life, which reduces net income without affecting cash. For example, if you record $5,000 in depreciation on machinery, you add this amount back since no actual cash is spent. Changes in working capital involve adjustments for current assets and liabilities. For instance, an increase in accounts receivable reduces cash flow as it’s money owed but not yet received, while an increase in accounts payable boosts cash flow as it’s money you owe but haven’t paid yet. These adjustments provide a clearer view of your cash position beyond just net income.

- Categorize Transactions: Divide cash movements into operating, investing, and financing activities.

- Calculate Net Cash Flow: Summarize cash inflows and outflows to determine your cash position.

Example of a Cash Flow Statement

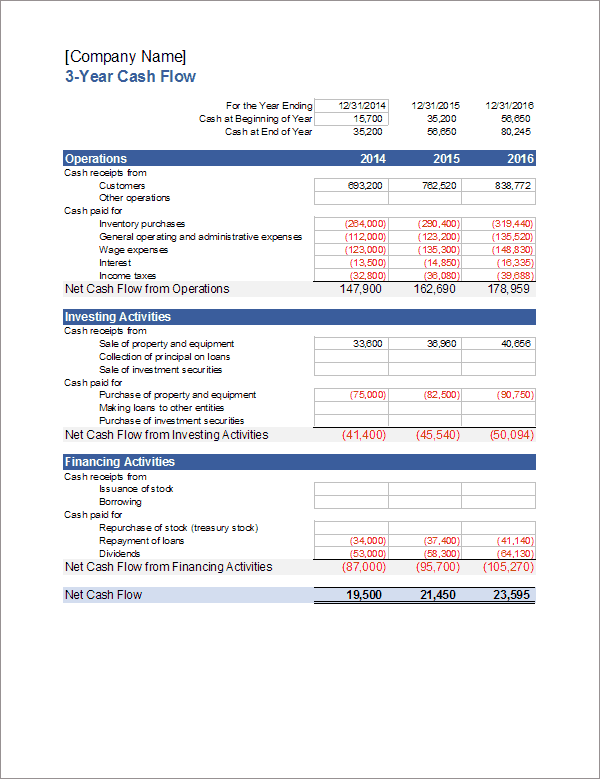

Below is an example of a cash flow statement template:

[Insert Image of Cash Flow Statement Template Here]

What the Example Contains:

- Header: Clearly labeled “Cash Flow Statement for the Period Ending [Date]” to specify the reporting timeframe.

- Operating Activities: Lists cash inflows from sales and outflows for operating expenses, showing the net cash generated or used in operations.

- Investing Activities: Includes cash used for purchasing equipment or earned from selling assets, highlighting strategic investments.

- Financing Activities: Tracks cash flows from loans, debt repayments, and equity financing to reflect funding strategies.

- Net Cash Flow: Summarizes the cash position at the bottom, giving a clear picture of liquidity.

This template serves as a practical guide to understanding and creating your own cash flow statement, ensuring clarity and precision.

Common Mistakes to Avoid

Even seasoned business owners make errors in cash flow reporting. Avoid these pitfalls:

- Confusing Profit with Cash Flow: Profitability doesn’t always mean positive cash flow.

- Ignoring Timing Differences: Be mindful of when cash is actually received or paid.

- Overlooking Small Transactions: Even minor expenses add up and can skew your analysis.

Analyzing Cash Flow Statements

Once you’ve prepared your cash flow statement, it’s time to analyze. Look for:

- Indicates stability and operational efficiency, as it demonstrates whether your business’s core operations consistently generate enough cash to sustain daily needs. Regularly achieving positive cash flow in this category highlights a healthy and scalable business model, reassuring stakeholders about the viability of ongoing projects and future expansions.

- Ensure investments and financing align with your strategic objectives. For example, if your goal is to expand operations, consider how current cash flow can support the acquisition of new equipment or additional staff. Aligning your cash flow with these objectives ensures that your financial activities are purposeful and contribute directly to measurable outcomes. Additionally, review financing terms and investment returns periodically to adapt to changing market conditions and to seize new growth opportunities efficiently.

- Watch for frequent negative cash flow or over-reliance on financing. Consistently negative cash flow may indicate deeper operational inefficiencies, such as excessive costs or declining revenue streams. Over-reliance on external financing can lead to unsustainable debt levels and reduced financial flexibility. Additionally, frequent dips in cash flow might point to poor receivables management or irregular payment cycles, which can strain business operations. Addressing these issues proactively is essential for maintaining a stable and healthy cash position.

Conclusion

Understanding and managing your cash flow statements is a game-changer for your business. By breaking them down into their components and analyzing trends, you’ll gain invaluable insights into your financial health. Ready to take control? Start preparing your cash flow statement today and set your business on a path to sustainable success!